Independent Mortgage

Brokers in Plymouth

Expert mortgage advice, trusted by clients and backed by five-star service from start to finish.

Rated Excellent by Clients Across the UK

From Plymouth and beyond – homebuyers trust us to get the job done.

Work with us and get access to thousands of mortgage products from over 100 lenders – all in one place.

Our Mortgage & Protection Services

We offer expert, independent advice for every stage of your property journey – whether you’re buying, remortgaging, investing, or protecting what matters. Our dedicated team of mortgage brokers are here to guide you through the entire process.

Other Ways We Can Help

We also advise on:

- Self-employed & contractor mortgages

- Shared ownership & affordable housing schemes

- Specialist or adverse credit mortgages

- Equity release & later life lending

- Commercial finance

- Life insurance & Critical illness cover

- Income protection

- Business protection (e.g. key person or shareholder cover)

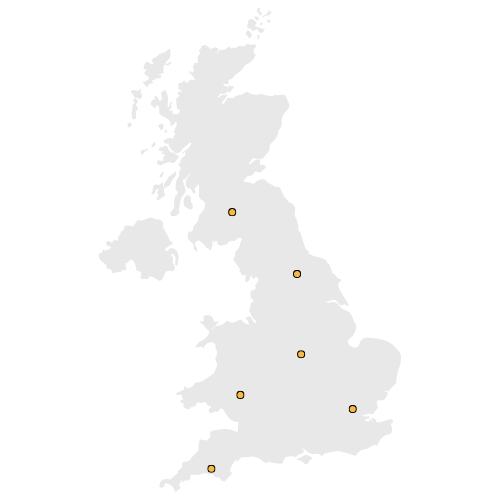

Local Expertise.

National Reach.

While we’re proud to call Plymouth home, we regularly help clients across the South West and the wider UK. We bring the same high standard of advice and support – wherever you are.

How to Find Us

Mortgage HQ

Ready to Talk Mortgages?

Expert, independent advice from a local broker who understands what matters.

Why Choose Mortgage HQ

We know what you’re thinking—getting a mortgage should be simple. But somewhere along the way, it’s become a maze of paperwork, jargon, and uncertainty.

- How much can I borrow?

- What’s the right mortgage deal for me?

- Do I need a survey?

- What’s the difference between a valuation and a homebuyer’s report?

- Do I really need life insurance?

Look – we get it. No one lies awake at night dreaming of a mortgage.

You want the house, the keys, the fresh start.

The mortgage? Just the bit in the way.

That’s where Mortgage HQ come in. Helping you get it sorted – without the faff, and without the guesswork.

FAQs

Ready to get things moving?

Book a free call now – no pressure, just honest advice.